When comparing anything to the peak numbers, you do need to be careful, though it’s still important to understand the signficant changes happening in the market.

In Jacksonville, over the peak years (2021-2022) with the Fed’s zero interest rate policy, investor purchases accounted for more than 30% of all purchases.

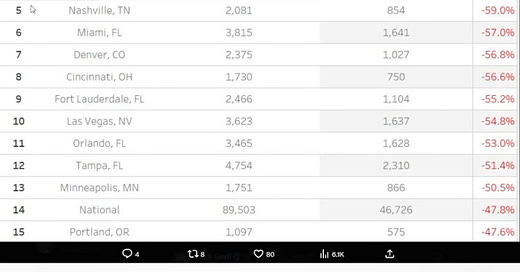

Today, we are seeing a 62.8% decline in investor purchases from the peak market, per Redfin. The math isn’t mathing anymore. The large institutional single family rental investors have nearly stopped all purchases - American Homes 4 Rent, Progress Homes, Invitation Homes, etc.

These companies were buying up to 40+ properties per month from 2013-2022, and since March 2022 when interest rates started moving up, the buying from these institutional investors primarily slowed and then stopped.

To learn more about how these changes impact YOU and your investments, click here. You’ll also get access to the charts and details you need to know.

“Florida’s home prices are dropping, inventory is high, and HOA fees and insurance costs are soaring amid the increasing frequency of natural disasters” - Redfin.

thinkbigquestioneverything.com

jon@movewithmomentum.com

explore Momentum, top ranked & rated brokerage in Jax: movewithmomentum.com