“Financial freedom is available to those who learn about it and work for it.”

― Robert Kiyosaki, Author of “Rich Dad, Poor Dad.”

Money. Financials. Profit.

This is the language of the real estate industry, yet I have not seen in-depth, public discussions of brokerage or team financials. If they are out there, please let me know -- I would love to connect and collaborate.

In our local market, at least, this money convo is absolutely taboo. In fact, some brokers and team leaders affirmatively refuse to talk about it. A common response to an agent’s request for more details on financials is often, “Don’t worry about splits, worry about overall compensation.”

In fact, I’ve personally observed that some team leaders, when asked about financials, simply stop talking to you at all, sometimes claiming, “You don’t get it.”

But I do get it. I suspect they don’t want to talk to agents about financials because they believe it’s not in their best interest for agents to know exactly how the money pot is split. Although these “leaders” work in a performance-based industry, they prefer to focus on gross pay and broad concepts because they don’t want to tell agents what they make off that big, fat commission that results from an agent’s hard work.

So, for most agents, that is the end of the money conversation.

But it shouldn’t be. To understand the financials of their profession, and the distribution of the profit pie, agents should be asking – and getting honest answers to -- many questions about money. Primary among them: How much money are you, my broker/team leader, making off my efforts.

If they refuse to tell you, is it because they know it’s way too much? Maybe they think if you knew, you’d try to negotiate it down. Or be motivated to find another brokerage or team with a better split, one that recognizes the agent is the source of the money coming in and, as such, should be the primary beneficiary of the gross commission they earn.

Or, if they won’t answer, is it because they have failed to do the math themselves? But if they haven’t bothered to run the numbers, how can they actually care about your financial success?

And if they tell you they don’t make money off you, you should probably know that, too. Because if they make no money from your work, they may well be at risk of financial ruin; I’ve seen that before. You could be joining under someone who is not financially savvy, and that does not bode well for you.

You know my mantra: You become who you surround yourself with, especially financially.

Getting Down to the Nitty Gritty.

Coming from an investment banking and finance background, I’ve had the great privilege of breaking down the financials of Fortune 500 companies, and running economic impact studies. I’ve stuck my nose into the annual 10-Ks and footnotes to find the juicy nuggets offering insight into a big company’s performance, in order to find that small competitive edge over those not paying as much attention to the details.

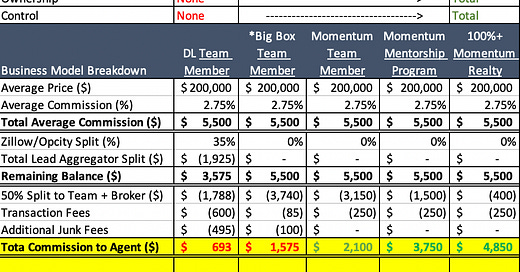

The same idea applies to real estate, although the math is far simpler. All you have to do is pull out your calculator, or, if you’re super savvy, do the math in Excel. But to make it easier, I put together a handy chart that compares several different brokerage/team models used in the local area, with comparisons based on a home sale of $200,000 and a commission of 2.75%.

The first example on the chart is a local independent brokerage model that works with big lead aggregators, as described by several Momentum agents who previously worked there. (More than one local brokerage operates with a similar model). Because they described it as devaluing their work with micro-management and lopsided splits, we’ll call it the Devalued Life team, or “DL Team.”

The second example is a traditional Big Box brokerage model used by its teams, also similar to ones that many Momentum agents left behind.

Third is the model used by many of the real estate teams working with Momentum (“Momentum Team Member”).

The fourth example is the model used for agents under the Momentum Mentorship Program, where new Momentum agents are mentored and trained by experienced agents through a 10-sale program.

Finally, the fifth model is the one used for full Momentum associates (“100%+ Momentum Realty”).

Ready? I think the differences will blow your mind!

Crazy, right? The range of net pay on the five types of models runs from a low of $693 with the independent brokerage like the DL Team, to a high of $4,850 as a full associate with the Momentum Realty independent brokerage.

Here’s another interesting way of looking at it: Assuming working 40 hours per closing, and four $200,000 closings per month, a DL Team Member nets a meager $17.32 per hour.

That’s before paying employment tax, licensing fees, gas/mileage, and probably their own health insurance.

They are basically an employee with no benefits, making just above the proposed Federal minimum wage of $15 per hour.

And, I’m not gonna lie: this financial reality makes me wonder whether buyers and sellers really want someone earning just above the poverty level to manage the largest financial transaction of their life.

Under the Big Box team model, an agent would net more than double that, but still a mere 28.6% of their commission. Using the above assumptions, it comes out to $39.38 per hour with the Big Box team. Not bad, but still employee status pay.

Under the Momentum models, team member agents would earn $52.50 per hour, mentees would net $93.75 per hour, and full Momentum associates would pull in $121.25 per hour. These are numbers that can lead to financial freedom.

Sitting down and doing the basic calculations reveals why many brokers and team leaders don’t want to talk money with their agents. It makes total sense that they don’t want you to do the math. Because at some brokerages/teams, while their agents are making barely above the poverty level of income, its “leaders” may be sitting back and making up to 50% of the gross earnings, with not a lot of skin in the game.

It’s no wonder that those models are like revolving doors for new -- then disillusioned -- agents.

Ask the Questions and Work the System.

There is no way around it: An agent has to demand their team leader/broker provide honest, detailed answers to their money questions. To make a decent decision, they have to know financials such as what % they will take home on each sale and be able to calculate what that translates to as a dollar-per-hour pay.

They need to get answers to questions like:

How exactly do the splits work?

What are the other fees I will have to pay?

What is the average house sales price at this brokerage/team?

What percentage of online leads worked result in a close?

How many hours, on average, are spent on each close?

How many closes per month do your agents average?

What is your company’s success rate for its agents?

What benefits do I get from working in real estate sales with your brokerage/team?

Agents also must know the numbers in order to know what to expect as a lifestyle. They may have to OUTWORK the financial model they have put themselves in.

For example, is it a model that relies primarily or exclusively on online leads? What happens if they dry up or the quality changes? Relying on online leads can be easy, but it also can lead to dependence, and a fear of leaving the comfortable – if poorly paid—workplace because they aren’t taught any other way to generate consistent business.

If that is your dilemma, note that Momentum knows how to escape its confine because Brittany and I have done it ourselves. In fact, we are the only real estate agents we know who entered a new market with no database and no money, but worked to become net worth millionaires in 3.5 years.

Request the numbers. Get the numbers, Analyze the numbers. And if your “leader” won’t provide them, or you need help analyzing them, or you just don’t like what you see, shoot me an email at jon@jonkbrooks.com for a private convo that could be the start of a whole new journey toward financial freedom.