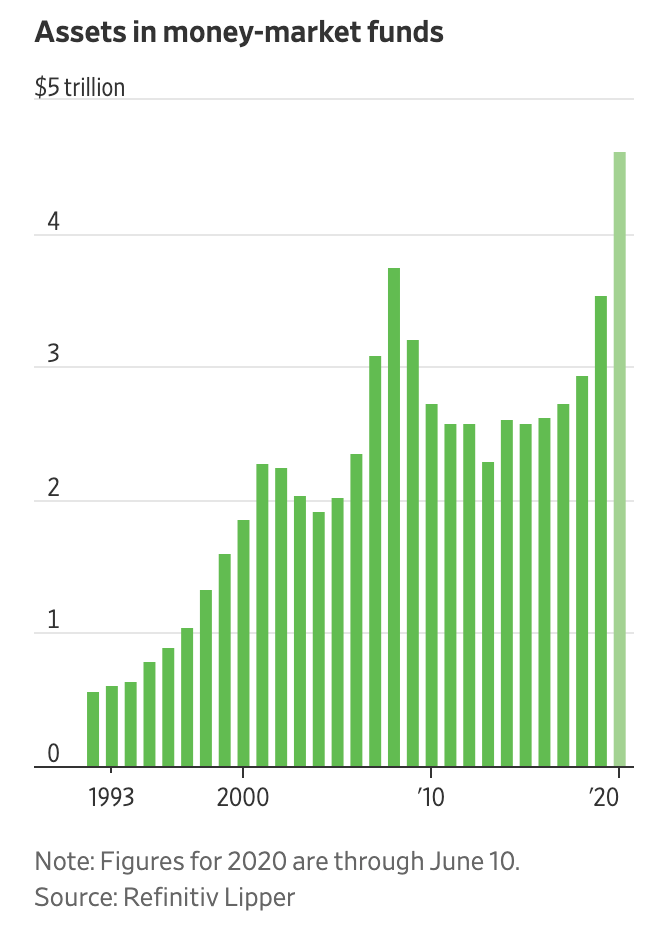

Top investors and entrepreneurs are pulling their risky assets off the table and moving more into cash.

Why?

Because only about 20% of the workforce is in public companies -- meaning that the stock market is not representative of what is really happening on Main Street.

The widening gap between the markets of Wall Street and the businesses of Main Street simply means increased risk for investors, and they are responding defensively by taking increased cash positions.

Maintaining a substantial cash position also can work to an entrepreneur’s advantage.

It means that, while conservatively positioned, entrepreneurs with cash are equipped to play both defense, by protecting against downside, and offense, by jumping at opportunities to maximize the upside at discounted prices.

There are clouds of uncertainty on the horizon. Between coronavirus, the November election, civil unrest, geopolitical tensions, and the list goes on.

It's likely we won't get back to some sort of normal until summer of 2021.

While taking some assets off the table and weathering the storm is prudent, most top investors are simply looking for better deals -- and at steeper discounts -- to account for the increased risk.

How are you preparing yourself for the next 12 months?